mibusiness

Navigating Medicare: An Optometrist’s Guide

It’s the 50th anniversary of Medicare in 2024, and next year marks 50 years since optometry’s introduction to what was formerly known as Medibank (now Medicare). As Simon Hanna writes, a lot has changed since eye care consultations commenced receiving rebates from the federal government’s Health Department.

WRITER Simon Hanna

In 1975, the government subsidy for optometry extended to four Medicare Benefit Schedule (MBS) items, including long and short consultations. Since then, with sustained lobbying and advocacy by individual and collective pillars in the optometry community, we have seen the MBS grow to 28 optometric items plus two items supporting patients’ access to telehealth services with ophthalmology.

The journey has not been without a few bumps in the road; optometry faced its biggest challenge when, in 1993, the Keating government made a concerted effort to remove optometry from the schedule. Through the lobbying efforts of the Australian Optometrical Association (currently Optometry Australia (OA)), the peak body was able to keep the wolves at bay and save optometry from its demise out of Medicare. Optometry Australia’s tireless advocacy also resulted in the ‘cap’ on fees being removed in 2015, supporting optometrists to be able to charge as they see fit for their clinical services and consultations.1

THE LANDSCAPE

The past decade has seen a marked increase in Medicare usage by optometrists, with the exception of 2020 when the pandemic impacted delivery of services. What is clear is that with the increase in both the overall and ageing populations, the demand for optometric services has never been greater.2 Add to that, the increase in scope of practice and it’s clear to see where the upward trajectory of services originates. Medicare Australia’s statistics, analysed over the past two decades, show a dramatic increase in demand for service since 2000. With the inclusion and approval of 41 therapeutic drugs in Victoria in 1998, the rapid expansion of legislation across other jurisdictions, and the inclusion of a diabetes-related Medicare item (10915) around the turn of the millennium, optometry commenced playing a key role in the general and eye health of Australians.

Since then, niche areas of care, including glaucoma collaborative care, myopia, and dry eye management, as well as speciality contact lenses, have seen further advancements in the delivery of professional eye care and increased investment from the government via Medicare.

The past two decades has seen an increase of over 200% in Medicare expenditure, with optometry rebates costing approximately AU$172m in the 2000–01 financial year and over $545m in 2022–23.3

A marked increase in Medicare expenditure can be found in specific items including 10912, 10913, and 10914, with the last two showing increases of over 1,000% between 2003 and 2023.3 This is in part due to the abolishment of item 10900 and introduction of two new items for comprehensive eye examinations for those under 65 years of age (10910) and those 65 and over (10911) in 2015. Patients can only be billed item 10910 once every three years. As a consequence, those under 65 receiving comprehensive care within the three years are being billed under these other comprehensive Medicare items (10912, 10913, and 10914).

Along with the 2015 Federal Budget changes in comprehensive eye care items, the sector also saw the introduction of five new Medicare items for optometry care. Item 10944 related to the removal of an embedded corneal foreign body and four items related to telehealth care with an ophthalmologist.

Persistent and successful lobbying from OA ensured that item 10944 was approved for the benefits of both patients and the profession. In addition, four new items were introduced for video-telehealth consultations between patients and ophthalmologists, where the interaction is facilitated by an optometrist. This has since been rationalised to two items: 10945 for those who require a telehealth consultation for 15 minutes or less, and 10946 for those over 15 minutes.

IMPACT OF THE PANDEMIC

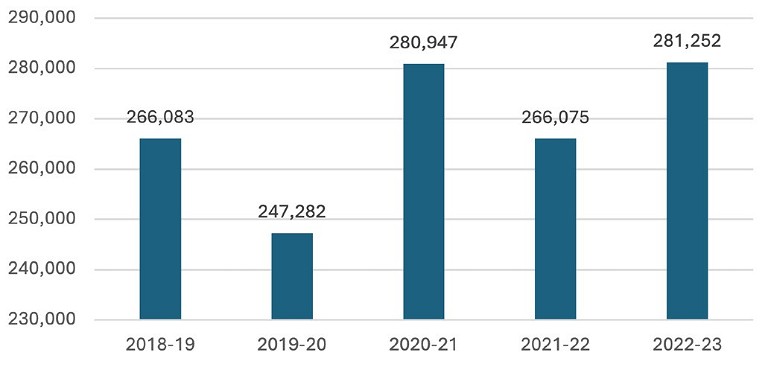

During the COVID pandemic period, the statistics show a clear reduction in Medicare item usage across the two-year period (Figure 1). The graph shows the fluctuation in item 10915, providing a patient rebate for comprehensive diabetes eye care examinations. Of the almost 19,000 less examinations conducted under 10915 in the 2019–20 financial year compared with 2018–19, almost a third came from one state: Victoria.

Diabetes Australia states that almost 1.9 million Australians have diabetes.4 Given the analysis related to the billing of item 10915, it is evident that only a fraction of people with diabetes are accessing comprehensive eye care in any given year. Others with diabetes may be accessing eye care via other optometry items or are under the care of other health care professionals.

This drop in item usage is not unique to item 10915, however. Indeed a drop of almost a million optometry services was noted across all items between 2019 and 2020, as eye care access was considerably limited during the first year of the pandemic.

RETURNING TO THE NEW NORMAL

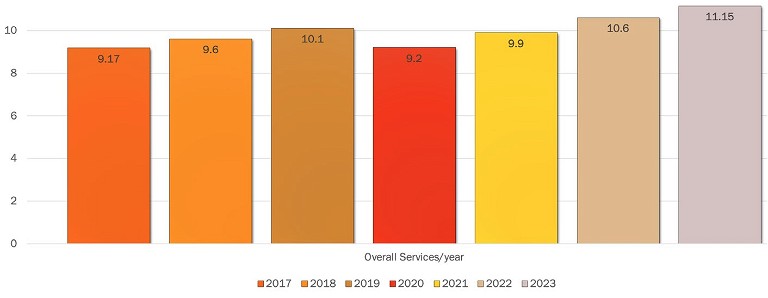

As we have moved into the post-pandemic era, what is evident from the data is that the delivery of eye care services has bounced back. Figure 2 shows that optometry Medicare billing topped 10 million services for the first time in 2019 and despite the dip in the subsequent two years, it has now exceeded 11 million services in the 2023 calendar year. This record number of services in one year equated to a record government contribution of over $566 million towards optometry. While not an insignificant sum, many in the optometry sector feel that the minor increase to fee rebates each year does not correlate with the ongoing increase of costs to run a practice and associated financial challenges.

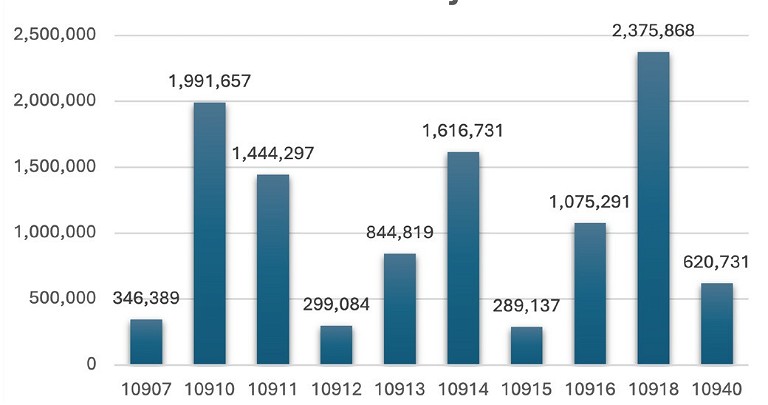

As we take a deeper dive into 2023, Figure 3 shows which items were most billed in that calendar year. What’s evident is the continued high usage of item 10918 – the short subsequent visit item. In fact, year on year, item 10918 has historically been the highest used item in the optometry Medicare schedule each year. This item has often been considered the ‘safe and convenient’ item where review consultations for returning patients can be safely billed, avoiding the higher paying items. However, considering that the rebate is half of the comprehensive visit, optometrists are now turning to other comprehensive items to bill patients requiring full eye examinations within their three-year or 12-month visit. These include items 10912, 10913, and 10914.

“The past two decades has seen an increase of over 200% in Medicare expenditure”

Item 10914, in particular, saw a 14% increase between 2022 and 2023, indicating a continual upward trend of using higher paying item codes for patients who present with progressive conditions that require greater than 15 minutes for a comprehensive review. With more optometrists managing patients with glaucoma, macular degeneration, and other progressive conditions, this pattern is not unexpected.

Historically, the Department of Health provided optometrists with a summary of their item usage and where each practitioner sat on the distribution curve in comparison with their colleagues. The provision of this data ceased many years ago, leaving many optometrists with less visibility on their individual billing usage. OA has, over the years, provided extensive education to ensure that optometrists remain compliant and understand their billing requirements.

An essential component of the services provided by the Department of Health is to ensure appropriate billing behaviour across all health professions. While most practitioners fear an audit and compliance check of their billing patterns and behaviour, an integral part of the government’s responsibility is to ensure that Medicare, the taxpayer-funded universal health care scheme, is being appropriately and responsibly used within the legislative framework and regulations, as stipulated by The Health Insurance Act (1973). It also serves as a deterrent of misuse or abuse of intentionally fraudulent billing.

Let’s look at how this compliance and audit system is set up.

PRACTITIONER REVIEW PROGRAM

The first step in a review of a practitioner’s Medicare billing is conducted by the Practitioner Review Program (PRP). The first thing to note is that a review by the PRP is not an indication of any wrongdoing or a judgment on the clinical care you provide your patients. It is the first step in understanding why your Medicare data differs from your peers.5 The initial inquiry from the PRP will usually take the form of a letter and/or phone interview with a member of the profession that supports the Department in better understanding your billing patterns. The objective is to identify any potential inappropriate practice that is taking place. As per the PRP website,6 inappropriate practice can fall into the following categories.

Unacceptable Conduct

A practitioner engages in inappropriate practice if the practitioner’s conduct in connection with rendering or initiating MBS services is such that a Professional Services Review (PSR) committee could reasonably conclude it was unacceptable to the general body of their peers.

Prescribing Patterns of Service

A practitioner engages in inappropriate practice in rendering or initiating services during a particular period if the circumstances in which some or all the services were rendered or initiated constitute a prescribed pattern of services. This is generally more relevant to medical practitioners who provide more than 80 professional attendances on each of 20 or more days in a 12-month period, (known as the 80/20) rule. At this stage, optometry does not have an equivalent rule.

Figure 1. Usage of Medicare Item 10915 across the past five financial years.

Figure 2. 2017–2023 Medicare services in optometry (millions).

Figure 3. 2023 most commonly used Medicare Items in optometry.

“… a review by the PRP is not an indication of any wrongdoing or a judgment on the clinical care you provide your patients”

Causing or Permitting Inappropriate Practice

Where a practitioner knowingly, recklessly, or negligently causes or permits a practitioner, employed or otherwise engaged by the person, to engage in conduct that constitutes inappropriate practice.

It is important to note that inappropriate practice is a peer standard, which essentially means that a practitioner’s conduct falls outside the standard acceptable to their professional colleagues.

Some of the factors that are considered when determining whether conduct is inappropriate include:

• The variance with which the practitioner’s usage deviates from the average of their peers. This includes total services, daily totals and/or the rendering of individual items.

• Analysis of whether the practitioner has abided by the MBS item descriptor wording.

• Whether the service that was delivered was ‘clinically relevant’. A ‘clinically relevant’ service is one that is generally accepted by the relevant profession as necessary for the appropriate treatment of the patient.

PROFESSIONAL SERVICES REVIEW

Where concerns are unable to be resolved under the PRP, practitioners are then referred to the Director of the Professional Services Review (PSR). In its administration of the Scheme, the PSR is responsible for reviewing and examining possible inappropriate practice by practitioners when they provide Medicare services or prescribe government subsidised medicines under the Pharmaceutical Benefits Scheme (PBS). A practitioner under review by the PSR will receive a letter requesting pertinent documents that may include clinical files as well as administrative information, including copies of appointment bookings.

The PSR will review the practitioner’s case following a legislative process that comprises of up to three stages:

Stage 1: Review of the Director of the PSR

Stage 1 of the PSR review is where the Director will obtain details of a random sample of services that were billed or prescribed by practitioners, employed or otherwise engaged by the practitioner, that relate to particular MBS and/or PBS items. The Director will then request medical records corresponding to that sample of services. Following a review of those records, the Director may seek to meet with you before preparing a report. You will have the opportunity to make submissions about that report.

Stage 2: Review by PSR Committee

If the Director of the PSR requires the practitioner’s case to undergo further review, Stage 2 is where a committee of peers is established by the Director, where at least three members are drawn from a panel of practitioners appointed by the Minister for Health and Aged Care. This panel use their expertise and experience to support the Director in determining if any inappropriate practice has occurred.

Stage 3: Determining Authority Makes a Decision

Following a committee’s finding of inappropriate practice, the Determining Authority (DA) has two main functions:

1. To determine what sanctions should be imposed following the Committee’s findings of inappropriate practice, and

2. To consider Section 92 agreements and either ratify or refuse to ratify them.

(Under section 92 of the Act, an agreement between a person under review and the PSR agency, would: (a) Require the practitioner to acknowledge that they have engaged in inappropriate practice in connection with rendering or initiating specified services during the review period; and (b) Include a ‘specified action’).

The DA must accept a committee’s finding and cannot revisit them.

As set out in section 106U of the Act, the possible outcomes of the PSR may include:

• A reprimand: A written or verbal reprimand given to the practitioner by the Director.

• Counselling: A verbal exchange of information given to the practitioner by the Director about why they were found to have practised inappropriately.

• Repayment: Repayment of some or all of the Medicare Benefit items that were billed and were found to have been provided inappropriately during the review period.

• Disqualification: Partial or full disqualification from billing certain Medicare items, providing Medicare services to a class of persons, or providing some or all Medicare items from a certain location for up to three years. In some instances, full disqualification from billing all MBS items for up to three years may apply.

In 2022–23, 69 negotiated agreements came into effect, including some with optometrists. Outcomes of these negotiated agreements included:

• Repayment orders totalling $14,399,084,

• Partial MBS disqualification in 41 cases, and

• Full disqualification from the MBS in two cases.

Repayments of up to $920,000 were agreed to, with half of the agreements involving a repayment of $150,000 or more.7

REDUCING THE STRESS

Practitioners who have been audited or reviewed by the Practitioner Review Program and/or the Professional Services Review Committee can find the experience both stressful and unsettling.

Optometry Australia has crafted three golden rules that are generally safe to follow if ever uncertain about which item to bill.8 These are:

• Was a clinically relevant or necessary service delivered (and recorded appropriately)?

• Were the terms of the MBS item descriptor met?

• Could you justify use of that item to a panel of your peers?

It is essential that practitioners make themselves comfortable and familiar with all of the items in the MBS related to their profession.

FINDING HELP

Getting that call with a request for a formal interview with Medicare might be the scariest day of a practitioner’s career. However, it’s critical to remember this doesn’t necessarily mean any wrongdoing on the optometrist’s part has been undertaken and it’s important to remember there is ample support.

Upon request for an interview, the first recommended action is to contact your professional association, Optometry Australia, where you will be expertly guided as to next steps.

“Getting that call with a request for a formal interview with Medicare might be the scariest day of a practitioner’s career”

OA’s help desk, supported by experienced clinicians, will guide and advise you to achieve the best possible outcome. OA also provides its members with legal counsel to help advise on a suitable course of action.

It’s also important to make yourself familiar with the exact period and Medicare items that the PRP is investigating and ensure that all clinical notes are available for review.

Reviewing and understanding the latest Optometry MBS, as well as the specifics of each item descriptor, goes a long way in developing confidence in billing appropriately. Keeping copious and contemporaneous clinical records also makes practitioners feel like they can justify a specific billing instance or pattern to an audit committee or their peers.

Simon Hanna is the Director of iCare Consulting, a firm that provides practices with tailored solutions and expert guidance to optimise operations, enhance compliance, and create practice efficiencies. From comprehensive audits to personalised training, iCare Consulting partners with businesses to achieve success in today's dynamic healthcare landscape.

References

1. Carter, H., Medicare a highlight in 100 years of milestones, webpage, Optometry Australia, available at: optometry.org.au/national_state_initiatives/medicare-ahighlight-in-100-years-of-milestones/ [accessed April 2024].

2. Australian Bureau of Statistics, 3222.0Population Projections, Australia, 2006 to 2101 (released 2008).

3. Services Australia, Medicare Item Reports (web page) available at medicarestatistics.humanservices.gov.au/statistics/mbs_item.jsp [accessed January 2024].

4. Diabetes Australia, Diabetes in Australia (webpage) available at: diabetesaustralia.com.au/about-diabetes/diabetes-in-australia/ [accessedJanuary 2024].

5. Department of Health and Aged Care, Practioner Review Program (web page) available at: health.gov.au/our-work/practitioner-review-program [accessed February 2024].

6. Department of Health and Aged Care, Inappropriate Practice (2022, last updated Feb 2024) available at: health.gov.au/resources/publications/inappropriatepractice?language=en [accessed March 2024].

7. Department of Health and Aged Care, Professional Services Review Annual Report 2022–23, available at: psr.gov.au/publications-and-resources/publications/annualreports/annual-report-2022–23 accessed March 2024].

8. Carter, H., Optometrists warned to be vigilant with MBS billing after big jump in Medicare repayments, Optometry Australia (web article), available at: optometry.org.au/medicare_private_billing/optometrists-warned-to-bevigilant-with-mbs-billing-after-big-jump-in-medicare-repayments/ [accessed April 2024].

Want more information?

Join Simon Hanna for a live case-based webinar on Tuesday, 9 July at 6.30pm (AEST), where he will outline the different Medicare items for optometry, how and when to use them, and cover a number of clinical cases. Time permitting, there will also be an opportunity for a question-and-answer session.