mieducation

Navigating Murky Waters: Private Health Rebates

The myriad rules surrounding private health insurance rebates available to optometry patients can provide a headache for eye health practices. Simon Hanna has advice on how to simplify the compliance process.

WRITER Simon Hanna

LEARNING OBJECTIVES

On completion of this CPD activity, participants should be able to:

1. Understand current market share and usage of private health insurance among optometry and other allied health professions,

2. Realise the trends across the past half decade and the implications, and

3. Consider the pitfalls of health insurance billing, compliance, and support for practitioners.

Under the Hawke Government in 1984, the re-elected Labor Government restored the publicly funded universal health scheme under its new name, Medicare. Private health insurance continued as a complement to the publicly-funded system, providing additional cover.1 This private system, through various iterations over the decades prior and since, has resulted in intended and unintended consequences for patients and the health system more broadly. As we have watched the evolution of the public and private systems over this time, the addition of allied health rebates into the private health scheme has seen the optometry sector face challenges. But it has also allowed the eye health profession to use the system both to its benefit and that of its patients.

The availability of health fund rebates has encouraged further access to comprehensive eye care through the annual rebates accessible for patients to use, based on clinical necessity for optical appliances.

Optometry patients opting to use their health insurance fund rebate, combined with the power of sector marketing, have ensured that more people are getting their eyes checked prior to obtaining spectacles and/or contact lenses.

At the same time however, this has also opened the possibility for practices and/ or practitioners to operate in a manner that may be considered non-compliant, whether it is intentional or otherwise. This article will investigate the private health fund market in Australia as it relates to optometry and explore the pitfalls that optometrists and practices can fall into.

CURRENT LANDSCAPE: MARKET SHARE AND USAGE

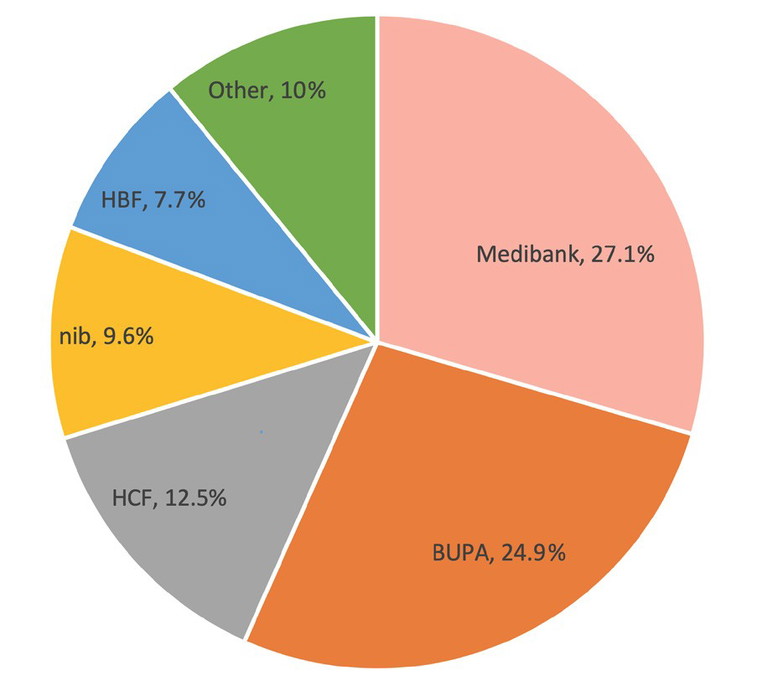

The 2024 Private Health Insurance Ombudsman’s State of the Health Funds report showed that there are currently 23 open membership private health fund options available to Australians. The same report showed that an additional nine restricted membership health insurers were available to specific sectors, including Police Health and Doctors’ Health.2 Of the 23 open membership funds, the report also revealed that in the 2022–23 financial year, Medibank had the largest market share with over 27% followed by Bupa with 24.9%, and HCF with 12.5% (Figure 1).2

ALLIED HEALTH

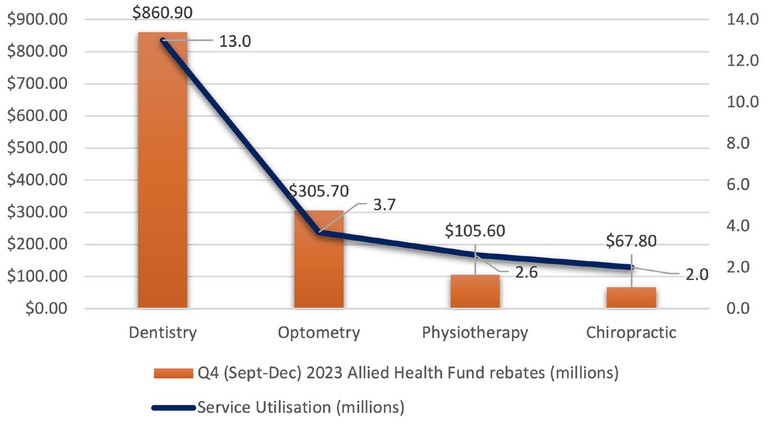

The Australian Prudential Regulation Authority’s (APRA) February 2024 quarterly statistic report, citing data to 31 December 2023, revealed that across all health funds, the major allied health beneficiary was dentistry. Over 50% of the total AU$1.595 million insurers paid in general treatment (ancillary) was for dental care across the October to December 2023 period. Figure 2 shows that optometry ranked second with $305 million in rebates, which equates to approximately 19% of allied health rebates paid out by funds collectively in quarter four (Q4) of 2023. It is also worth noting that the average benefit per service for optometry across the past four years was $77.75 compared with $65 in dental care.3

Figure 1. Market share across the top five health funds.

In parallel, looking at service utilisation, the pattern is similar, with dental care providing over 50% of the 26 million general treatment episodes recorded. Optical rebates made up over 10% with 3.7 million services in Q4 of 2023 and physiotherapy and chiropractic care rounding out the top four (Figure 2).3

OPTOMETRY IN PRIVATE HEALTH INSURANCE

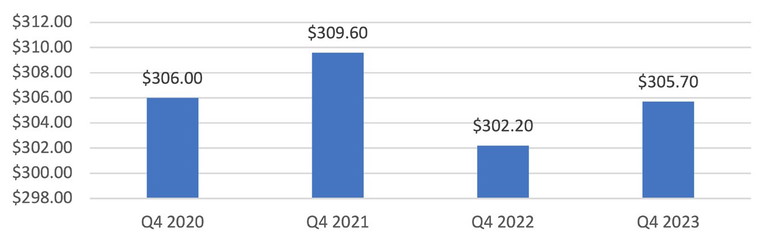

A closer look at the Q4 statistics across previous years shows a relatively consistent expenditure in optometry by health funds, despite the COVID-19 pandemic lockdowns restricting access to care for large periods of 2020 and 2021. In fact, over the past four years in Q4, the highest benefits rebate in the optical industry was in Oct–Dec 2021, indicating many Australians may have claimed benefits post the pandemic lockdowns as regular eye care services resumed (Figure 3).4

ITEM USAGE

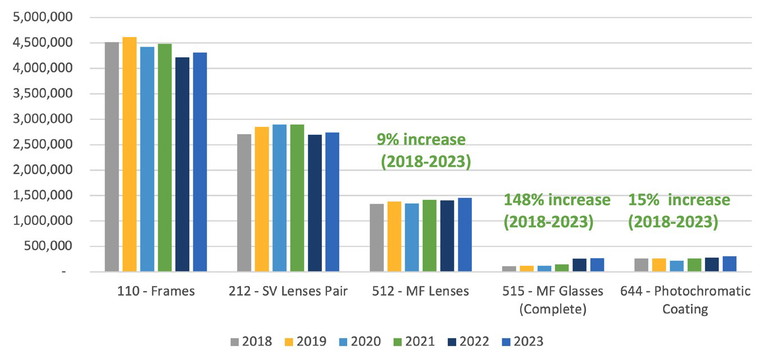

Recent data obtained by iCare Consulting shows the breakdown of service utilisation of health fund items related to optometry across the past six calendar years. As might be expected, items 110 (optical frames) and 212 (single vision spectacle lenses) topped the list with 4.3 million and 2.7 million claims respectively in 2023 (Figure 4).

Figure 2. Q4 2023 allied health fund rebates.

Figure 3. Q4 (2020–2023) optical health fund rebates (millions).

Anti-reflective coatings (item 662) and pairs of progressive lenses (item 512) followed with 2.5 million and 1.4 million respectively. Figure 4 also shows the frequency and trend of spectacle items and main lens coatings claimed across the past six years and the percentage change for some of the items.

Insights from the data also reflect that with an ageing Australian population, both multifocal (progressive lenses, item 512) and complete multifocal spectacles (515) claims increased across the past six years with the latter up almost 150% in that time period. Similarly, the photochromatic lens coating item (644) has also significantly increased, by 15%, as awareness of the harmful effect of the sun’s ultraviolet (UV) rays becomes more widely understood and promoted by health and eye care professionals.

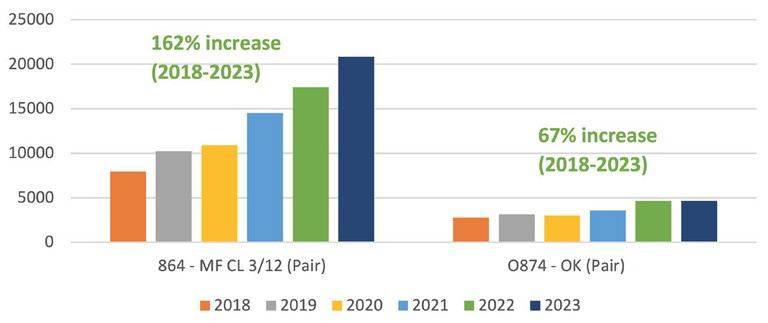

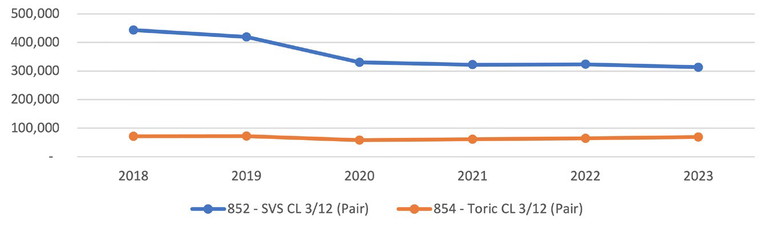

Analysis of contact lenses data (Figures 5 and 6) tells a similarly interesting tale. While single vision and toric contact lenses (items 852 and 854) have remained relatively consistent (and, in fact, 852 has reduced by 29%) since pre-pandemic levels, specialty lenses, specifically multifocal and orthokeratology (OK) lenses have seen a perhaps not-so-surprising increase across the past six years. Item 864 (multifocal contact lenses) has seen a year-on-year growth, again indicating that an ageing population is looking to alternative forms of vision correction to provide versatility. Item 874, claimable for the management of myopia with OK, has also seen a steady increase as myopia control becomes more mainstay

“The availability of health fund rebates has encouraged further access to comprehensive eye care through the annual rebates accessible for patients to use, based on clinical necessity for optical appliances”

ADVOCACY

Over the years, Optometry Australia (OA), as the peak body and voice of the profession, has been vocal in its support and reform of the private health insurance system. In 2017, the OA’s submission to the Senate Community Affairs Reference Committee on health fund reform encouraged seeking solutions for how to strengthen private health insurance to benefit consumers. In its submission, titled Inquiry into the value and affordability of private health insurance and out-of-pocket medical costs, OA advocated for better monitoring of potential anti-competitive activity and a close examination on the implications of private health funds acting as both the provider of health care services and products and insurers.5

NAVIGATING THE MINEFIELD OF DIFFERENT HEALTH FUNDS

For those optometry practices who strive to be compliant in their health fund billing procedures, the complexity of having so many different funds with different rules poses an administrative minefield and opens the risk to inadvertent non-compliance. Optometry Australia’s advocacy and ability to unify advice from across major health funds has gone a long way to ease this pain.

Figure 4. Spectacle frame, lens and coating items (2018–2023).

In 2021, OA published a member-only practice resource6 that took the most frequently asked questions by practitioners and had representatives from each fund provide its position. While an imperfect system to say the least, this collaborative approach went some way to assisting practices when processing patient rebates. All the major health funds, including Medibank, ahm, Bupa, HCF, nib, HBF, and Australian Unity contributed to this resource to provide improved transparency and assist practices in improving compliance. Some of the common questions addressed included:

• Can a rebate be used as partial payment at time of ordering, if the product is paid in full?

• Can a product (frame and lenses) be purchased over two years?

• Can a rebate be provided on a frame only, if the customer chooses to get lenses elsewhere?

• Do plano lenses need to be retained if a patient purchases a complete pair of prescription eyewear?

• Do rebates apply for sunglasses?

Alongside this practice aid, OA published an additional member-only consumer-facing resource,7 aimed at guiding patients when considering which optical extras cover may best suit their needs from the many fund options available. The consumer guide recommends patients consider their optical needs, waiting periods, maximum rebates, and any restrictions on the policy.

THE DOS AND DON’TS

While there are some variances in health fund rules, there are certain consistencies across the board that can hold a practice in good stead when navigating this landscape. These basic rules can be implemented across the practice to ensure compliance and peace of mind while running a busy store.

Figure 5. Items 852 and 854: single vision and toric contact lenses 3/12 (pair).

Figure 6. Specialty contact lens fit trends (2018–2023).

• Do confirm the patient’s identity prior to initiating electronic claims or issuing tax invoices or receipts for rebates.

• Do ensure all patient records (including clinical notes, scripts, tax invoices, receipts from electronic claiming facilities) are complete and comprehensive.

• Do ensure you inactivate any Medicare provider numbers if you cease practising at a specific practice. Even once a practitioner leaves a practice, that Medicare provider number can be stored on the electronic funds transfer at point of sale (EFTPOS) terminal and can be used to claim health fund rebates for optical appliances the practitioner hasn’t prescribed. Inactivating Medicare provider numbers for specific locations can be done via the health practitioner’s Provider Digital Access (PRODA) account.

• Don’t use available health fund rebates for anyone other than the patient who clinically requires the optical appliance. This includes other family members that are listed on the health fund card. This is often requested by patients to avoid paying the gap on their optical appliances and is prohibited by all health funds. Membership benefits are not transferrable.

“While the prospect of an audit and request might be daunting for most practitioners, it’s important to remember that the primary objective of an audit is to ensure compliance”

“Becoming familiar with overarching health fund principles and rules across the sector, as well as understanding some of the nuanced differences between health fund rules, is vital to ensure you remain compliant”

• Don’t use available health fund rebates for patients who do not have a clinically necessary prescription. Health fund rebates are only available to patients who have an optical prescription that is clinically necessary to prescribe.

• Don’t retain private insurance cards or process transactions where the cardholder is not present to verify the transaction.

AUDITS AND COMPLIANCE

Any audit or compliance check on a practitioner or business can result in stress and concern. It’s important to note from the outset that an audit is usually random, and taking place as a matter of routine. It’s also important to remember that if you have attempted to comply and adhere to the health fund rules, there should be little to worry about. Often an inadvertent error in one patient claim is less likely to result in any serious consequences. What is more often identified is the excessive fraudulent and intentionally incorrect claiming pattern of health fund rebates. These do raise flags on the health fund systems and can result in financial repayments, fines, and can even incur a suspension from claiming rebates for a certain period of time.

GETTING HELP AND NEXT STEPS

While the prospect of an audit and request might be daunting for most practitioners, it’s important to remember that the primary objective of an audit is to ensure compliance. If the practice has been compliant, then there is usually no negative outcome. If the practice or practitioner is contacted by a health fund, the first recommended action is to contact your professional association. OA has an expert team to help navigate and guide next steps, including notifying your professional indemnity insurer.

Becoming familiar with overarching health fund principles and rules across the sector, as well as understanding some of the nuanced differences between health fund rules, is vital to ensure you remain compliant as a practice or practitioner. While there are endless potential computations and case presentations, remaining compliant can be made simple by setting up practice policies and communicating those clearly to patients and staff alike. This might take the shape of a poster at the reception of your practice or in your electronic reminders to patients regarding their next appointment. It will also act as a deterrent for patients who are inclined to request you might ‘bend the rules’ to suit their needs or for financial gain.

To earn your CPD hours from this article, visit mieducation.com/navigating-murky-watersprivate-health-rebates.

Simon Hanna is the Director of iCare Consulting, a firm that provides practices with tailored solutions and expert guidance to optimise operations, enhance compliance, and create practice efficiencies. From comprehensive audits to personalised training, iCare Consulting partners with businesses to achieve success in today’s dynamic healthcare landscape. www.icareconsulting.com.au.

References

1. Duckett S, Nemet K. The History and Purpose of Private Health Insurance, Grattan Institute, July 2019, available at: grattan.edu.au/wp-content/uploads/2019/07/918The-history-and-purposes-of-private-health-insurance.pdf [accessed March 2024].

2. Commonwealth Ombudsman, State of The Health Funds Report Relating to the Financial Year 2022–23, available at: ombudsman.gov.au/__data/assets/pdf_file/0018/302940/SOHFR-2023-final-2024-03-27-002.pdf [accessed March 2024].

3. Australian Prudential Regulation Authority. Statistics: Quarterly Private Health Insurance Statistics, December 2023, released 28 Feb 2024. Available at: apra.gov.au/sites/default/files/2024-02/Quarterly%20Private%20Health%20Insurance%20Statistics%20December%20 2023_0.pdf [accessed March 2024].

4. National Library of Australia Trove Archive, APRA Statistics, available at: 5. Optometry Australia, Inquiry into the value and affordability of private health insurance and outof-pocket medical costs: A submission, available at: webarchive.nla.gov.au/awa/20240315002210/https://www.apra.gov.au/statistics-0 [accessed July 2024].

5. Optometry Australia, Inquiry into the value and affordability of private health insurance and out-of-pocket medical costs: A submission, available at: optometry.org.au/wp-content/uploads/Policy/Submissions/optometry_australia_submission_to_the_senate_community_affairs_reference_committee___july_2017.pdf [accessed July 2024].

6. Optometry Australia, Private Health Insurance Rules and Rebate Conditions, 2021 available at: optometry.org.au/practice-professional-support/medicare-private-billing-health-funds/private-health-fund-rules/ [memberonly resource, accessed August 2024].

7. Optometry Australia, Helping your patients, 2021 available at: optometry.org.au/practice-professional-support/medicare-private-billing-health-funds/private-health-fund-rules/ [member-only resource, accessed August 2024].

Webinar

Want more information? Join Simon Hanna, director of iCare Consulting, for a live case-based webinar, where he will deep dive into some of the pitfalls in the private health insurance billing space and outline how to best navigate these with case examples. Wednesday, 27 November at 7pm (AEDT). Scan or go to bit.ly/3MEu0PU to register.